Half-Time for Salaried Employees

“The FLSA permits employers to pay non-exempt employees a fixed salary for a fluctuating workweek and to compensate them for their overtime hours on a ‘half-time’ basis.” 29 C.F.R. § 778.114(a). Under this method, an employee is paid a fixed salary covering whatever number of hours the job demands in a given week. With straight time already compensated in the salary, only one-half the basic rate (half time) must be paid for overtime. The amount of the half-time payment will vary depending on the number of hours worked in excess of 40 hours in the workweek.

An employer may use the half-time method of calculating overtime only if:

- The employee understands that his/her salary is meant to cover all hours worked;

- The parties have a clear understanding that the salary (apart from the half-time payments) will not fluctuate even though the job demands that the employee work more or less than 40 hours in a given week (to avoid confusion, it is recommended that the understanding be in writing or a policy is distributed to employees); and

- The salary is large enough to assure that the average hourly wage never falls below the FLSA minimum wage.

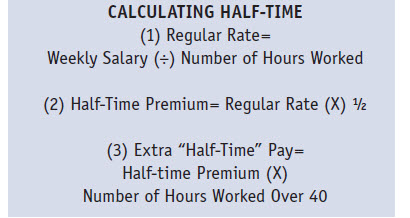

“To calculate half-time, one must first determine the regular rate of pay by dividing the weekly salary by the number of hours actually worked during the week. The employee’s half-time premium would be determined by multiplying the regular rate by one-half. Thus the extra half-time pay would be calculated by multiplying the half-time premium by the number of hours over 40 worked in a week.” 29 C.F.R. § 778.114(a).

Example:

A salaried employee works 50 hours in a week at a salary of $500. The employees’ regular rate of pay would be $10 an hour. Under half-time, the employee would be entitled to one-half the $10 regular rate for all overtime hours worked. Thus the employee would be entitled to $5 an hour multiplied by the 10 hours of overtime worked, or $50 in extra overtime pay.

In this example, the half-time overtime premium is $50 while the regular time-and-a-half overtime premium would be $187.50. Thus, half-time pay is considerably more advantageous to the employer. The advantage of half time for the employer becomes greater the more hours that are worked because the hourly premium pay goes down. The disadvantages of using half time include problems of employee morale, difficulty in retaining good personnel, and administrative problems in calculating pay.