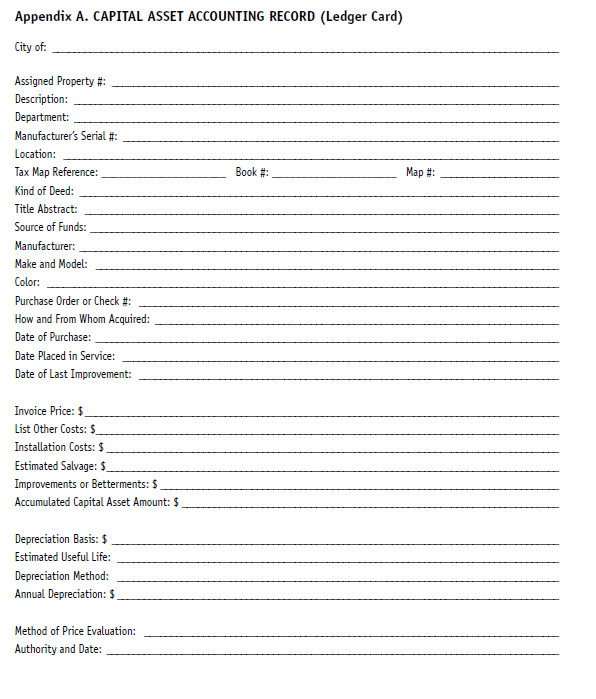

Form - Capital Asset Accounting Record (Ledger Card)

The following explanations are offered to assist with completing ledger cards.

Accumulated Capital Asset Amount: Include in this amount the initial cost plus betterments to arrive at total investment cost.

Authority: Name of the person, board or council authorizing disposal of the asset.

How and From Whom Acquired: The “how” should indicate whether the asset was acquired through condemnation, as a gift, etc.

Method of Price Evaluation: Indicate how the price of the asset was determined. If other than cost, the name of the person making the evaluation should appear on the next line.

Other Comments: Should be used to report anything unusual or unique about this asset.

Property Number: This refers to the CAAS number assigned to this particular capital asset. It should be noted if this number has not been affixed to the asset.

Reference: This space should be used to indicate the source of the authority, such as minute book number and page number.

Source of Funds: This refers to the fund financing the asset, as well as whether by rental, purchase, etc.

Tax Map Reference: For counties in which the reappraisal program has been completed, this information can be obtained from the tax assessor.